This month we will look at two Xero addons, specifically beneficial to accountants in Sydney, to help you manage staff and track your jobs. Below are the features of each add-on.

Xero Projects Add-on allows you to manage all your jobs/projects on the go.

- $10 per user/ month;

- You can allocate task time estimates and budget costs to each job so you can monitor and track the time and cost allocated to each job;

- Have a very flexible invoicing solution – you can create fixed price, time or material and progress payment invoicing;

- You can track and allocate staff expenses/reimbursements to a specific job;

- Real-time job costing and time tracking reports can be generated on the go (one single dashboard showing all your jobs and their status)

- Ideally suits service industries.

- Website https://www.xero.com/au/features-and-tools/accounting-software/projects/?gclid=EAIaIQobChMIw-2D7uiz3AIVB6qWCh2x1Q9jEAAYAyAAEgKb4fD_BwE&gclsrc=aw.ds&dclid=CJnjxfDos9wCFVcgYAodJecFLg

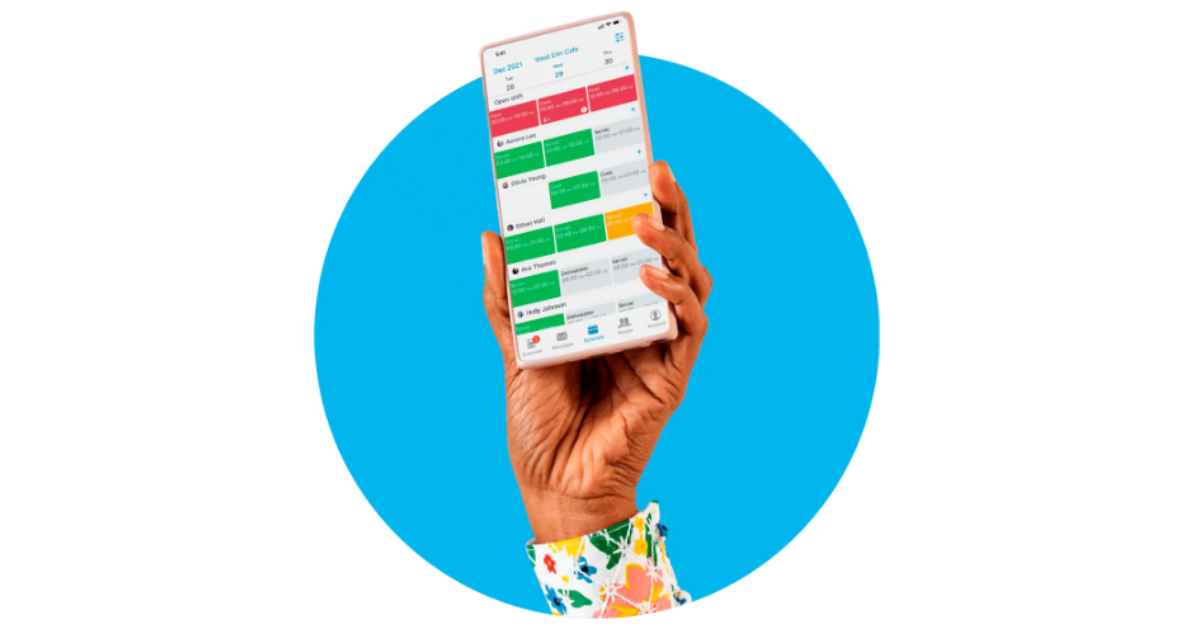

Deputy Add-on is a staff and workforce management tool. You can schedule, track and manage people on the go.

- Starts at $2 per user/month

- Can track and capture when an employee starts and stops a scheduled shift;

- Can automatically generate invoices and send them to the client/customer based on hours worked;

- You can track and monitor scheduled time and costs with actuals (eliminates time theft);

- You can deliver messages to staff before or at the end of their shift using the Newsfeed tool;

- Multiple-user settings allow you to give people different access levels so you can maintain confidential data like salary numbers;

- A deputy can be customised to suit the specific needs of your business (for complex and more extensive businesses).

- Website https://www.deputy.com/

As always, if you need any assistance with Xero or any bookkeeping tools, please get in touch with our bookkeeping team.

Kreston Stanley Williamson Team

*Correct as of July 2018

Disclaimer – Kreston Stanley Williamson has produced this article to serve its clients and associates. The information contained in the article is of general comment only and is not intended to be advice on any particular matter. Before acting on any areas in this article, you must seek advice about your circumstances. Liability is limited by a scheme approved under professional standards legislation.