Accounting and advisory services for businesses that are serious about growth

Whatever stage of the business life cycle you’re at, we help you move to the next

Where are you in your DREAM Business Lifecycle™️?

It's all about progress. Whatever stage of the business you are in, Kreston Stanley Williamson can help you progress to the next. Support and advice at every stage of business growth is what we offer.

Design

It’s a long journey from a business idea to an actual real-world business. We help you decide if it’s possible to get there.

Realise

You decide that the business idea is feasible. We help you set the wheels in motion for the long journey ahead by creating a strong business foundation.

Evolve

The business is evolving. You need to ensure that the right people, processes and procedures are all in place and that you’ve minimised risk.

Accelerate

Growing pains are normal but businesses with big aspirations are prepared to take the tough steps to accelerate growth into the future.

Mature

Is it time to exit or pass on the business? If so, do you want to invest and build further wealth or start again with another business?

Services

Grow your business faster with the right advice

Tax, accounting, audit and business advisory services for every stage of the business life cycle

Company

Helping Australian companies grow since 1969

Our founding partner, Bill Stanley, started out offering accounting and tax services in Sydney in 1969. Over half a century later his legacy remains a big part of our firm.

Highly skilled team

Over the decades, we’ve grown into a celebrated firm of accountants, tax consultants, and business advisors, providing tailored solutions with a forward-thinking approach that clients can relate to and easily understand.

140 years of experience

Our five partners now have over 140 years’ combined experience to help you build your dream business.

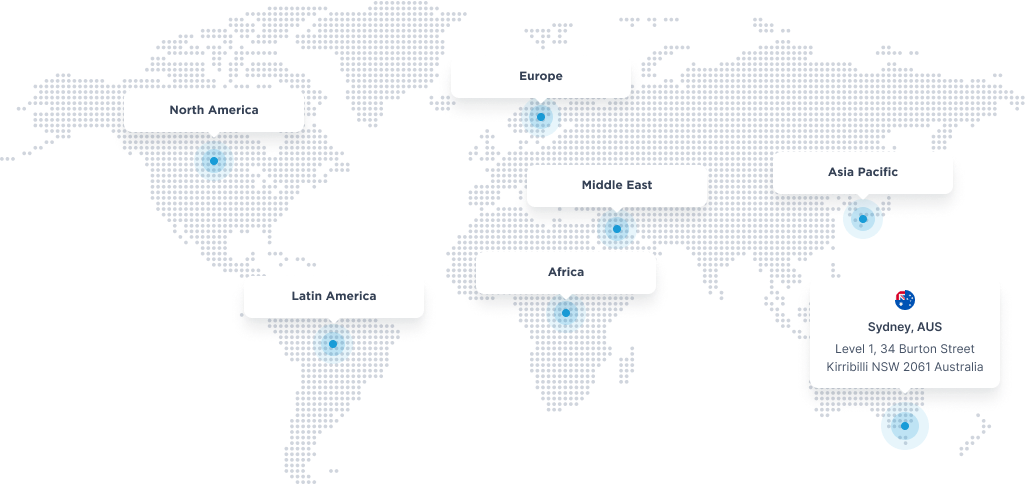

Global presence with local insight

We are part of Kreston Global, an international advisory and accountancy network of 160 firms in 115 countries worldwide. If you want to expand internationally, we have the support to help you succeed.

160

member firms

6

continents

114

countries

Solving the business problems you never expected to face

Here are some examples of how business owners successfully overcame their challenges to achieve their desired results with our guidance and expertise.

Latest Articles

Process

The next steps

Start your journey towards achieving your business goals by allowing us to offer you quality accounting and advisory solutions with a transparent, no-surprises fee structure.