The EU has introduced the Sustainable Finance Disclosure Regulation (SFDR) to boost transparency in financial markets. SFDR mandates that financial market participants disclose sustainability information, aiding investors in making informed decisions about sustainable investments and assessing how sustainability risks are factored into investment choices. This regulation aligns with the EU’s objective of attracting private funding to support Europe’s shift toward a net-zero economy. Currently, the European Commission is conducting a comprehensive evaluation of SFDR, focusing on aspects such as legal clarity, usability, and its effectiveness in combating greenwashing.

Sustainable Finance Disclosure Regulation (SFDR)

Under SFDR, financial market participants and financial advisers are obliged to inform investors about their approach to considering sustainability risks that could impact the value and returns on investments (‘outside-in’ effect) and the adverse environmental and societal impacts of such investments (‘inside-out’ effect). Market participants must provide this information for specific products and for their organisation as a whole. They are required to do so through their websites, in product pre-contractual documents, and in annual reports.

It’s important to note that SFDR does not compel market participants to prioritise green criteria when making investments. Instead, it establishes regulations that necessitate them to substantiate sustainability claims associated with their financial products. These regulations apply to financial market participants managing investments on behalf of end investors, including asset managers, insurance companies, pension providers, and investment firms.

Open for Consultation

On September 14, 2023, the European Commission initiated targeted and public consultations regarding the implementation of the Sustainable Finance Disclosures Regulation (SFDR). These consultations are open to input from stakeholders and the general public until December 15, 2023. This process seeks valuable feedback and insights to further refine the implementation of SFDR.

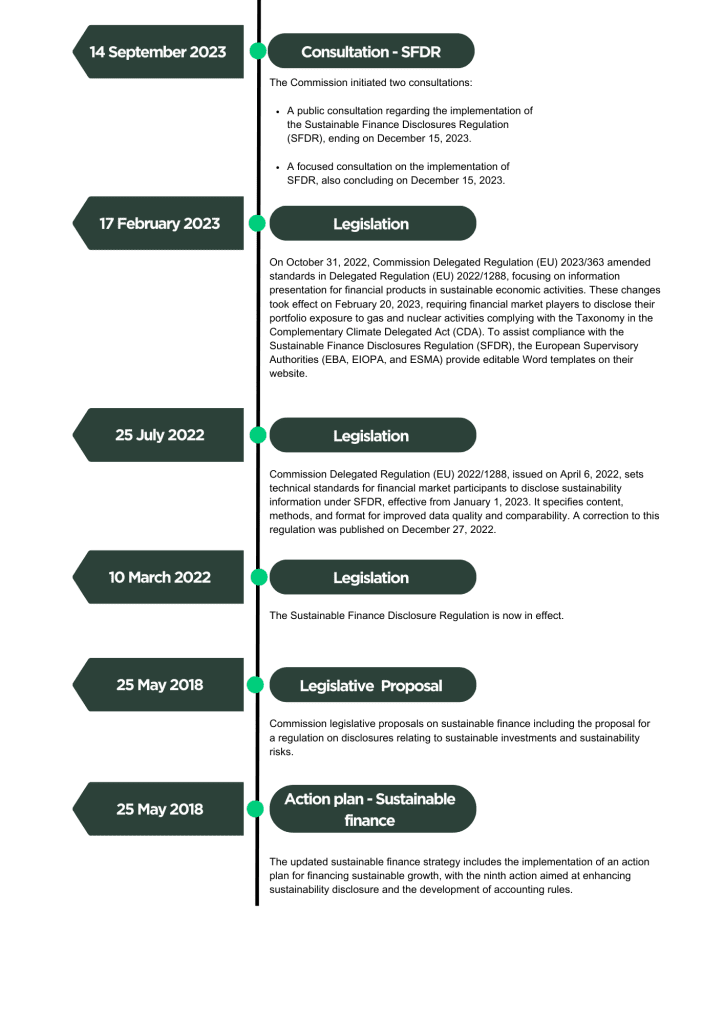

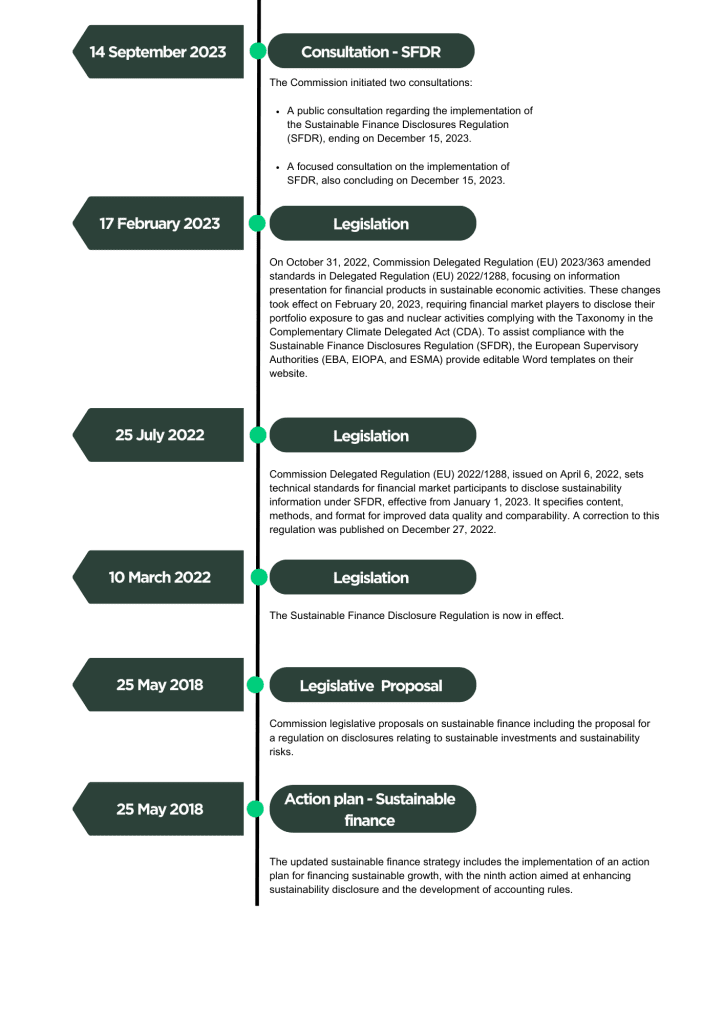

Policy Making Timeline

More information on this topic can be found in the original article produced by the European Commission.

Kreston Stanley Williamson

*Correct as of 04 October 2023

*Disclaimer – this article has been produced by Kreston Stanley Williamson as a service to its clients and associates. The information contained in the article is for general comment only and is not intended to be advice on any particular matter. Before acting on any areas contained in this article, it is imperative you seek specific advice relating to your particular circumstances. Liability is limited by a scheme approved under professional standards legislation.