After a couple of articles in previous editions of KSW Insight you will have heard about the new rules which require directors of Australian companies to obtain a Director Identification Number (director ID). The new requirement to obtain a director ID applies to all directors of companies in Australia, including directors of corporate trustees of SMSF’s. All these directors will need to apply for their own director ID by the prescribed deadline.

Whether it is for your own company, or for the trustee of your SMSF, this document provides some important information about Director Identification Numbers, including how to apply for one and by when.

An application for a director ID must be made individually and only by those who are applying for the director ID. As you are required to prove your identity as part of the process, our firm, or any other third party, is not able to apply for a director ID on your behalf.

What is a Director Identification Number (director ID)?

A director ID is a unique identifier that directors need to apply for, like a tax file number. If you are a director of multiple companies, you are only required to have one director ID that will be used across all companies. You will keep your director ID forever even if you change companies, resign altogether from your director role(s), change your name, or move overseas.

Why do I need a Director Identification Number?

As part of the Government’s Digital Business Plan, it is rolling out a Modernising Business Registers program which includes the introduction of Director IDs. The main purpose is to prevent the use of false or fraudulent director identities as well as to improve the efficiency of the system by making it easier to meet registration obligations and trace director activity and relationships. By improving the integrity and security of business data it is expected to reduce the risk of unlawful activity.

How do I apply for a Director Identification Number?

There are 3 key steps to apply for your director ID.

Step 1: Set up myGovID

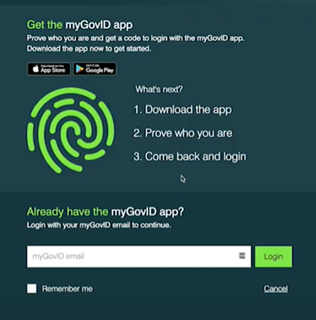

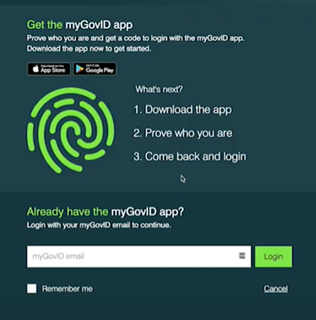

If you do not already have a myGovID you will need to set this up before you can apply for your director ID online. You can find information on how to setup your myGovID by downloading the app at: https://www.mygovid.gov.au/set-up . This may take several minutes to verify.

Note, myGovID is different to your myGov account. Your myGov account allows you to link to and access online services provided by the ATO, Centrelink, Medicare and more, while myGovID is an app that enables you to prove who you are and to log in to a range of government online services, including myGov.

Step 2: Gather your documents –

You will need to gather some information that the ATO already knows about you to verify your identity. You will need your tax file number, your residential address held by the ATO, and information from two of the following documents:

- Bank account details

- ATO notice of assessment

- Super account details

- Dividend statement

- Centrelink payment summary

- PAYG payment summary.

Most of this information can be downloaded from your myGov account so it may be worthwhile linking to this service ahead of applying for your director ID.

Step 3: Complete your application –

Once you have a myGovID and the information to verify your identity, you are ready to apply for your director ID. The application process is quick and should take you less than 5 minutes. You can click on the following link to start the application process where you’ll be taken to the following screen: https://abrs.gov.au/persons/ui/secure/start/applyForDirectorID?action=applyfordirectorid

You will need to enter in your myGovID email.

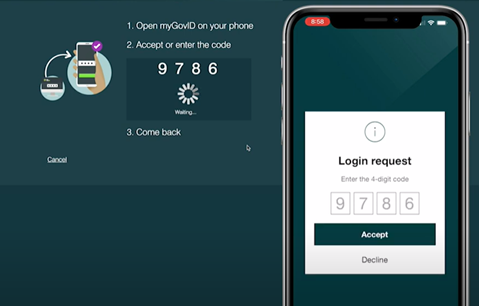

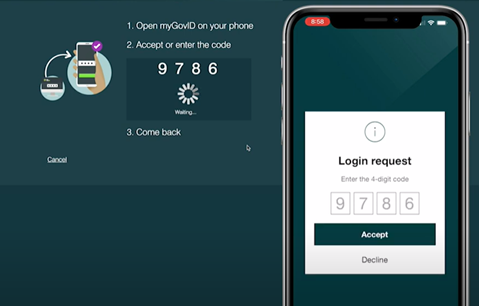

Then open up your myGovID app on your device and enter in the code given to verify your details:

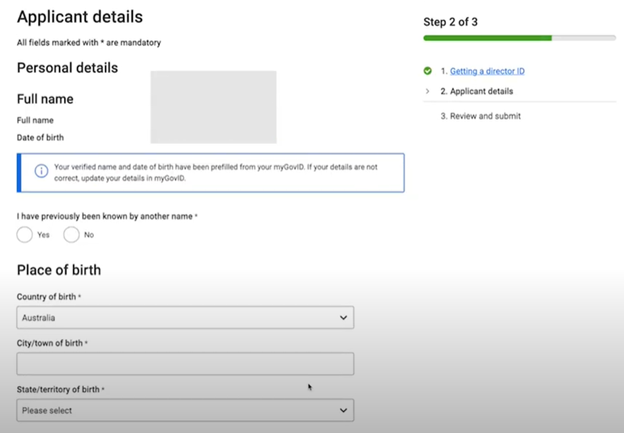

You will then need to submit proof of record ownership by reading the prompts and agree to the terms to proceed and check the details given by the ATO, and click Next:

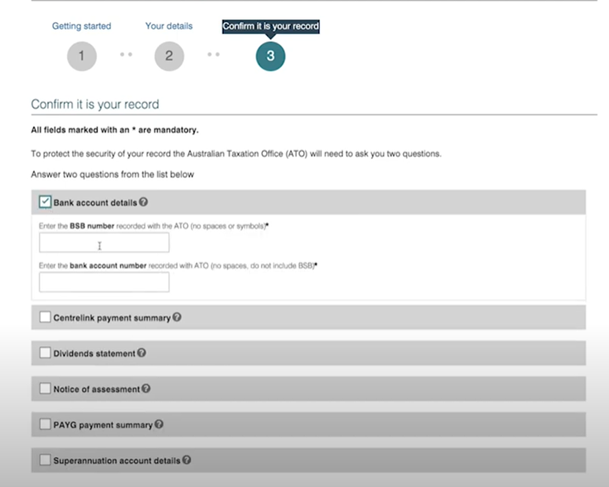

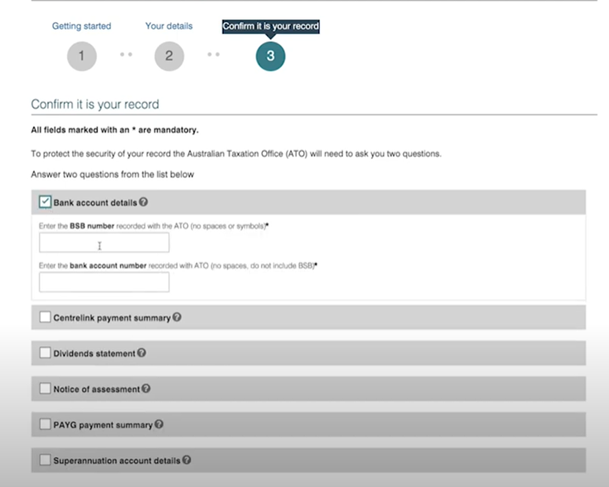

You will then need to provide two pieces of information to confirm it’s your record – these should be your personal details and not those of your company, then submit:

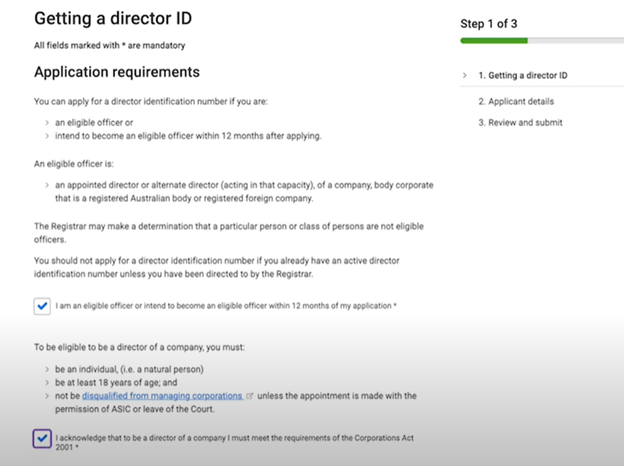

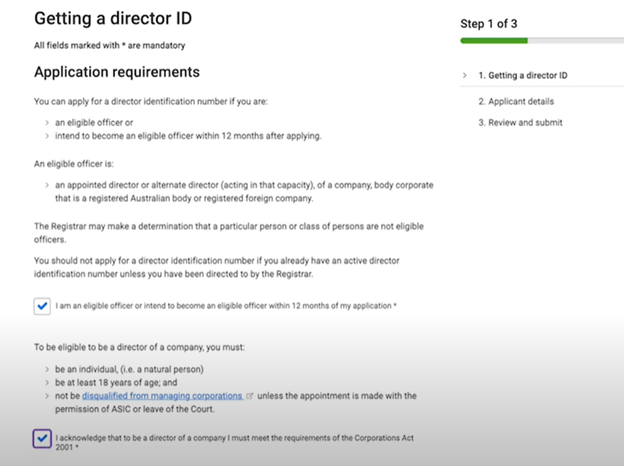

Then you’ll be taken to the Director ID page – read the prompts and confirm that you are an eligible officer or intend to be within the next 12 months:

Then enter your personal details and select Next:

Then check the declaration and your details before submitting:

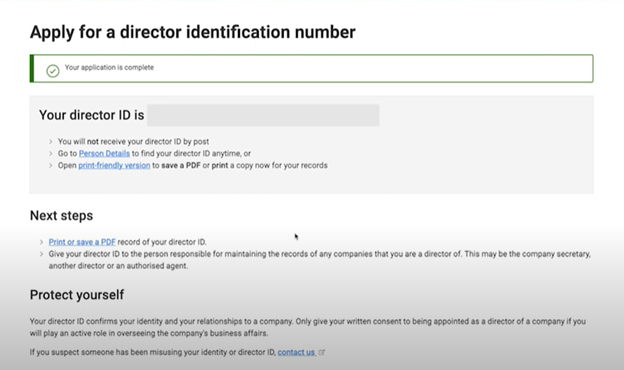

Your Director ID will then be immediately issued:

Further information about the application process, and step-by-step instructions, can be found via this link: https://www.abrs.gov.au/director-identification-number/apply-director-identification-number

Step 4: Keep your Director Identification Number in a safe place and notify us of the number –

Once you have been issued your Director ID, keep this number with your permanent records in a safe location. Also notify your SMSF administrator or us so we can record this number.

By when do I need to have a Director Identification Number?

The director ID deadline depends on when you were first appointed as a director of any Australian company. This may or may not be when your company or your SMSF corporate trustee company was established. Please contact our office if you are unsure which deadline applies to you.

| Date you first become a director | Date by when you must have applied for a Director Identification Number |

| On or before 31 October 2021 | By 30 November 2022 |

| Between 1 November 2021 and 4 April 2022 | Within 28 days of appointment |

| From 5 April 2022 | Before appointment |

As always, if you have any queries in relation to the director ID registration don’t hesitate to contact our office for help.

Author – Anna Wong

*Correct as of 4 August 2022

*Disclaimer – this article has been produced by Kreston Stanley Williamson as a service to its clients and associates. The information contained in the article is of general comment only and is not intended to be advice on any particular matter. Before acting on any areas contained in this article, it is imperative you seek specific advice relating to your particular circumstances. Liability limited by a scheme approved under professional standards legislation.