Navigating the Foreign Exchange and International Payments realm can prove challenging for SMEs in Sydney. The ever-changing landscape of the Aussie dollar, providers who tend to be more reactive than proactive, and outdated processes/payment platforms all present unique obstacles for today’s business owners needing reliable accountants in Sydney.

Below are some common issues business owners encounter and some easy-to-follow tips for your FX risk.

Be aware of FX risk

Over the last 10 years, AUD/USD has had, on average, a 16% range on a 12-month calendar basis. This poses an ongoing and significant risk to the profit levels of any company that needs to buy or sell the AUD.

By speaking to an expert about a robust hedging policy, companies can hedge against this, therefore protecting a budgeted rate of exchange and, in many cases, increasing profit versus the budgeted levels.

Be aware of different products.

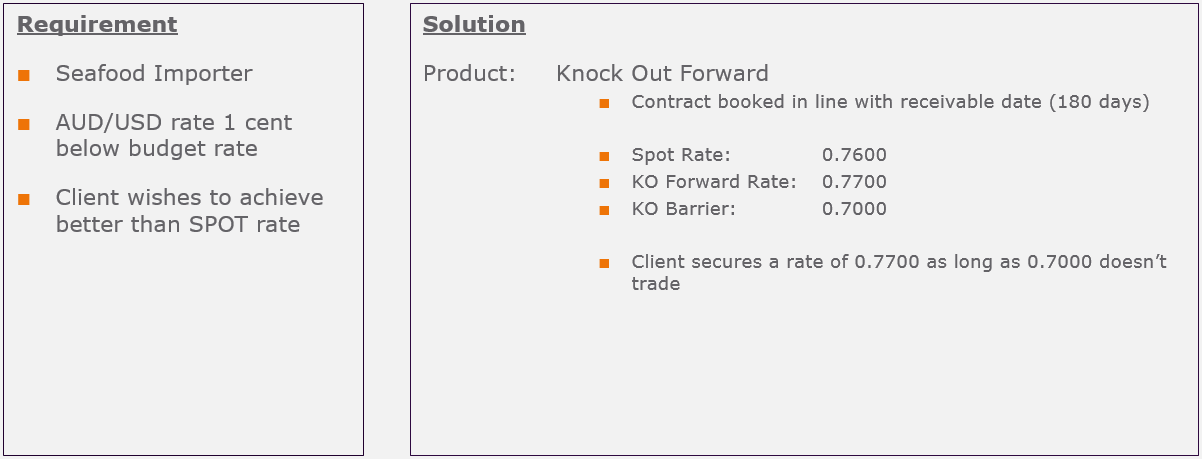

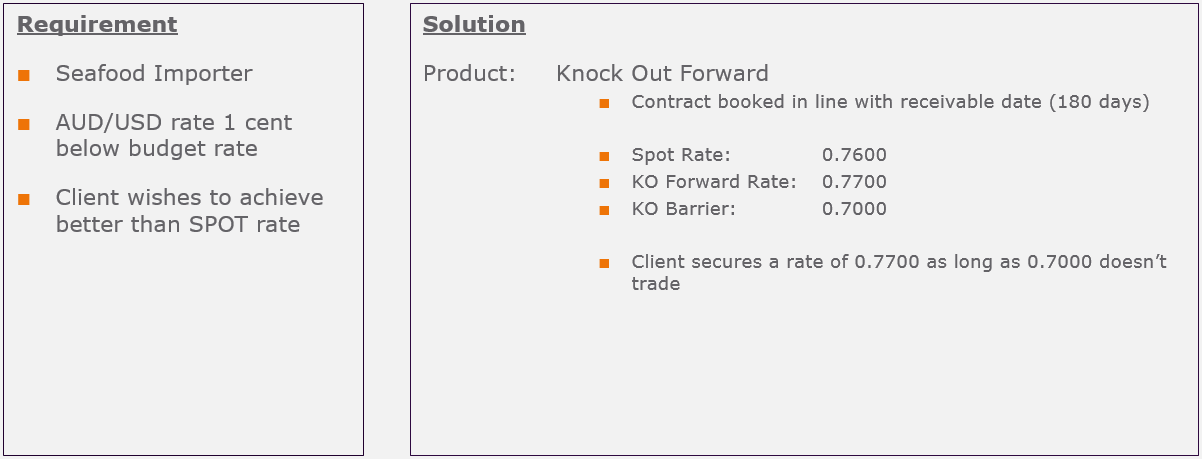

Too often, businesses are uninformed about their options. The FX Market is far more wide-ranging than just an online platform and basic Forward Contracts. Unaware of the products at a business owner’s fingertips could leave a company with an ineffective hedging strategy.

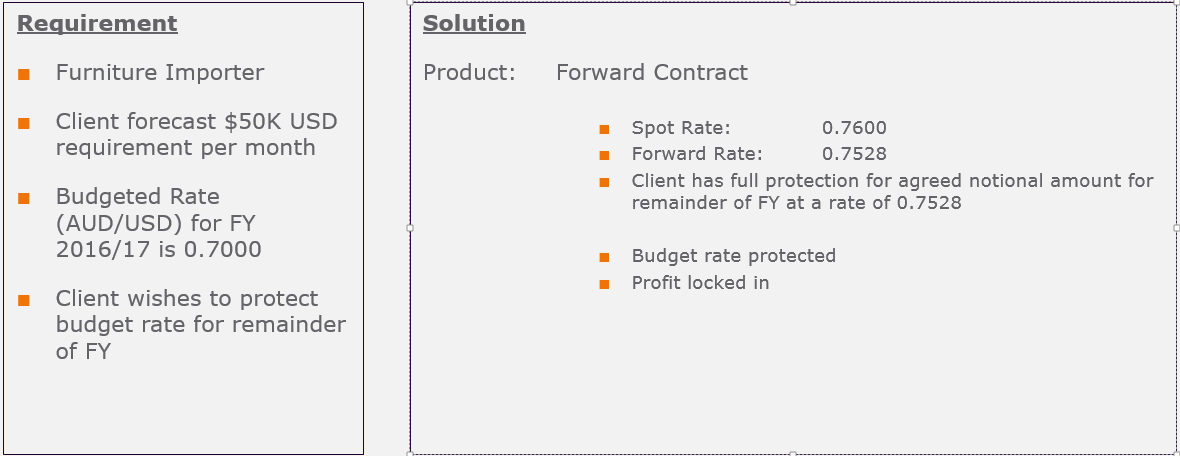

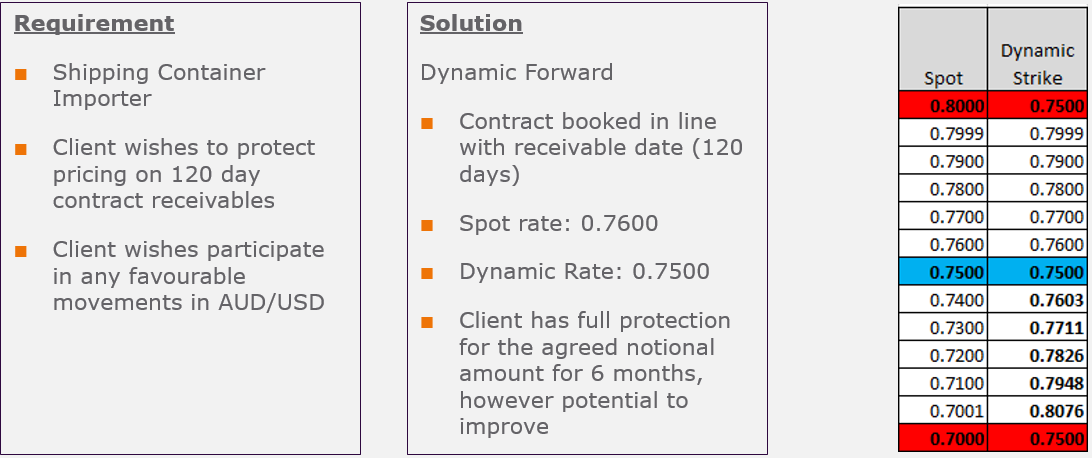

Below are some examples of these effective hedging solutions.

Take advantage of technology.

End-of-month and monthly payment cycles regularly fill Account Purchase (AP) departments and management with dread. As the old adage goes, “time is money,” which rings true in this case. Often a drawn-out and laborious manual process, there can be nothing more frustrating or cost-ineffective for an AP department than spending hours entering payment after payment.

Innovative payment solutions that integrate with operational processes and users’ busy lifestyles are essential to reducing AP costs and streamlining workflows for today’s business owners.

Example 1

Example 2

Example 3

In summary, it’s imperative to speak to an expert in the field, as they can offer a full suite of hedging products and the expertise and experience to develop a robust, flexible hedging strategy that aligns with specific needs and requirements.

Our guest writers, Aaron Jackson and Alessandro Borghese, wrote the article at Cambridge Global Payments.

Kreston Stanley Williamson Team

*Correct as of November 2016

Disclaimer – Kreston Stanley Williamson has produced this article to serve its clients and associates. The information contained in the article is of general comment only and is not intended to be advice on any particular matter. Before acting on any areas in this article, you must seek advice about your circumstances. Liability is limited by a scheme approved under professional standards legislation.