Xero Analytics Tool

Xero, a leading accounting software company, continuously strives to enhance the experience for business owners in Sydney by introducing innovative tools to optimise their operations. Among their latest offerings is an advanced cashflow analytics tool, available in two distinct versions, highly beneficial to accountants in Sydney. These cutting-edge tools empower business owners to efficiently manage their finances and make informed decisions for sustainable growth.

- Analytic Basic provides two dashboards: short-term cash flow and business snapshot. It is free and comes as part of the Xero subscription for Starter Plan and upward; and,

- Analytic Plus will cost you an extra $10 per month. However, it is currently free for you to use until January 2022.

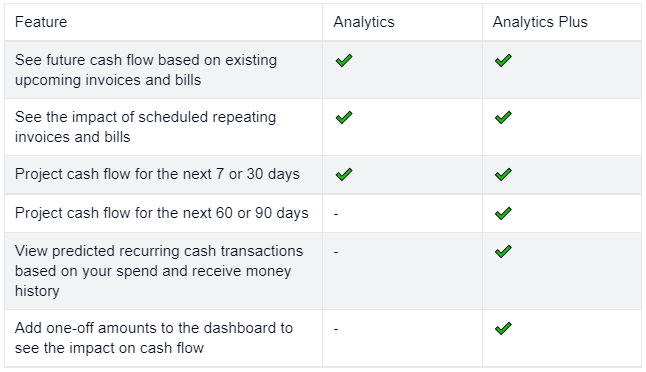

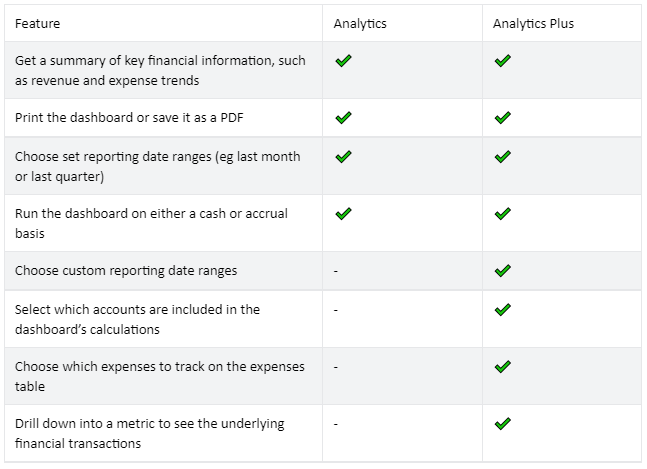

Extra features of the Analytic Plus version:

- Customisable date ranges for reports;

- Prediction for up to 90 days;

- You can edit cash prediction by adding/deleting scenarios and,

- Better insight and reporting for your business, including cash flow and profitability.

Tips for getting the Cashflow Analytic tool to work better for you:

- Sales Invoices and Bills must be entered correctly and regularly into Xero;

- You need to ensure the Xero file is regularly updated (i.e. weekly or monthly reconciliations are done for the bank, debtors and creditors); and,

- Ensure the collection, payment terms, and details are updated in Xero for all invoices and bills – especially the Expected/Planned Date.

For more information and to compare the two versions, please refer to the tables below.

Some of these enhancements may significantly help with the management of your business. If you want to discuss the above tools with your specific circumstances, please don’t hesitate to contact us.

Author – Quang Tat

*Correct as of 15 November 2021

Disclaimer – Kreston Stanley Williamson has produced this article to serve its clients and associates. The information contained in the article is of general comment only and is not intended to be advice on any particular matter. Before acting on any areas in this article, you must seek advice about your circumstances. Liability is limited by a scheme approved under professional standards legislation.